Im not really good in explaining this, because I totally suck in bank stuff, but when I got a chance to have a lunch with some folks at BPI, I was informed that their new offering for a BPI Housing Loan has the lowest rate in the market, that’s 4.7% per annum.

BPI Family Bank's housing loan offers was launched under their “BPI Family Savings Housing Loan All Out Promo”, under their promo -- they will take care of the incidental fees up to PHP 60,000 when you acquire a new house, this means that the incidental fees that you need to pay for processing some documents will be covered by BPI, no more stress for you to pay for it because it is now covered by your housing loan at BPI.

Why they do this?

They do this because they want the Filipino people to get a much more flexible term for their housing loan. They can use the housing loan in buying a condo space, house and lot or an existing property. Plus you get option for the interest rate 1) 4.75% fixed for 1 year or 2) 6% fixed for 5 years.

It was advised that choosing the fixed rate is better than having a variable interest rate, it means that the rate wont change during the duration of your loan, this will give you a less stress state because you wont worry for any increase of rate every year because you chose the fixed rate interest for your housing loan. I think the fixed rate is untouchable even if there’s inflation in our economy, just correct me if Im wrong.

Instead of paying more...you will save at least PHP148,000 if you are using the 6% rate fixed for 5 years.

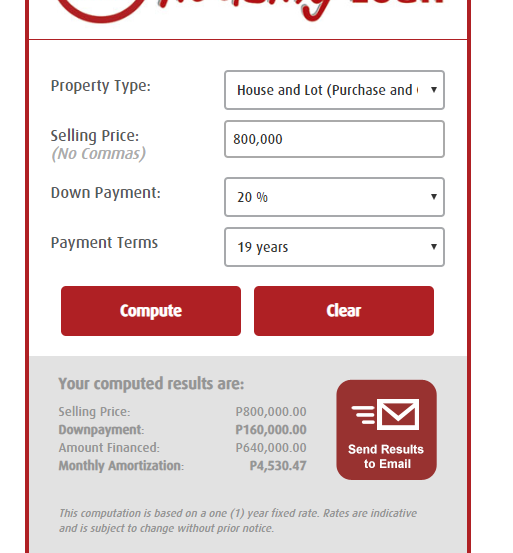

Their housing loan will let you borrow money up to PHP 400,000 with a term of 10 years and you can borrow up to PHP 2.5M, but that depends on the price of the housing unit you want to acquire and also the rate you can pay back BPI. They have an online calculator for you to try to check if how much you can pay based on the price of the housing and also the loan you need.

Just go click https://cal.bpihousingloans.com/loan-calculator/bpi-family-housing-loan

Here’s a sample that I made using the calculator

I heard about those low cost housing under 1M, but heres’s a sample that I used for the calculation.

This promo will be up to June 1 to October 31, 2018, and the promo is open for all borrowers who avail the BPI Family Savings Bank Housing Loan or Property Equity Loan from June 1 to October 31, 2018, and their loan application are already approved and booked by December 31, 2018.

Why they do this?

They do this because they want the Filipino people to get a much more flexible term for their housing loan. They can use the housing loan in buying a condo space, house and lot or an existing property. Plus you get option for the interest rate 1) 4.75% fixed for 1 year or 2) 6% fixed for 5 years.

It was advised that choosing the fixed rate is better than having a variable interest rate, it means that the rate wont change during the duration of your loan, this will give you a less stress state because you wont worry for any increase of rate every year because you chose the fixed rate interest for your housing loan. I think the fixed rate is untouchable even if there’s inflation in our economy, just correct me if Im wrong.

Instead of paying more...you will save at least PHP148,000 if you are using the 6% rate fixed for 5 years.

Their housing loan will let you borrow money up to PHP 400,000 with a term of 10 years and you can borrow up to PHP 2.5M, but that depends on the price of the housing unit you want to acquire and also the rate you can pay back BPI. They have an online calculator for you to try to check if how much you can pay based on the price of the housing and also the loan you need.

Just go click https://cal.bpihousingloans.com/loan-calculator/bpi-family-housing-loan

Here’s a sample that I made using the calculator

I heard about those low cost housing under 1M, but heres’s a sample that I used for the calculation.

This promo will be up to June 1 to October 31, 2018, and the promo is open for all borrowers who avail the BPI Family Savings Bank Housing Loan or Property Equity Loan from June 1 to October 31, 2018, and their loan application are already approved and booked by December 31, 2018.

Read more info: https://www.bpihousingloans.com/pages?page=Housing-loan-rates