More innovation for payment have been launched by GCash, you can now use the app in purchasing in selected stores and malls nationwide by the use of the QR code scan to pay and it provided an option for cashless payment system in a secured and fast way of payment and also remit money from abroad.

Today, Gcash can now lend you money with the use of their app starting with a PHP5,000 credit limit. There’s no longer need to fill up more documents and wait for approval, all you need is to have a Gcash app, get a KYC verification, Re-load it with cash, use it for transaction for payments, bills, remittance or load.

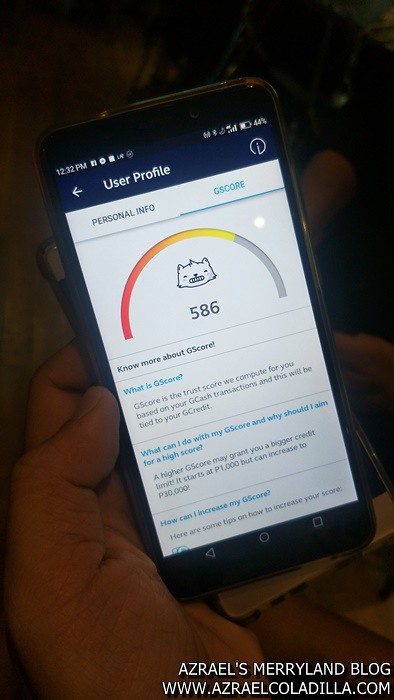

Gcash will be using their Gscore rating system, a trust score that will determine if you are capable of paying them back and they gather data on how you use the Gcash app for payment, the more you use the Gcash app, the more score you receive and get a big chance to be approved by Gcash based on your Gscore rating.

Gscore is powered by Fuse Lending, a licensed lending company owned by Mynt, the fintech startup owned by Globe Telecom, Ant Financial, and Ayala Corporation that also owned Gcash.

The Gscore can create data through machine learning and it can recognize Gcash app user who are qualified to be approved for the Gcredit. Today, the Gcredit is on beta stage and they are approving 100,000 users who are qualified who have a higher Gscore rating. Gcredit will roll out soon within the year and they have plans of increasing the credit limit to Gcash app users who have high Gscore rating. Expect that it will be more than PHP 5,000 in the future.

So how many Gscore rating you need? If you open your app and at the menu settings, you can see your Gscore rating. For more chance to get a Gcredit approval, you need at least around 400 Gscore, but more chances if you around 500 Gscore.

At present, many Filipinos have no other recourse but to turn to informal or unlicensed money lenders usually called “five-six” since they extend loans without collateral or documentary requirements. In exchange, they charge the borrowers exorbitant interest rates of 20 percent or higher, thereby, leading to a debt trap where people find it hard to break out of a borrowing cycle just to stay afloat.

This situation could be avoided through GCredit. With GCredit, once a customer pays their credit balance, it replenishes instantly. This provides customers peace of mind so they can have access to funds whenever they have emergencies or life milestones. As added benefit, those who continue to use and pay their GCredit properly will be given higher GCredit limits. –info from GcashTake note that the PHP5,000 Gcash borrowed money can be used only for Gcash transaction. As of now, you can only use it for QR code scan to pay system in malls and stores and also pay your bills by using the Gcash app. No news yet if it will be available for Gcash withdrawal using the Gcash card, but as of now Mynt is on test ground to see the response of the users, more features will be added soon.

To pay back, you just need to reload your Gcash app and pay for the Gcredit cash you borrowed. Take note that there’s a 5% monthly interest rate, and that’s PHP25 , and according to Gcash, you can also get more lower interest rate if you use the Gcash app heavily.

If you want to be part of the whitelist for the Gcredit, then start using your Gcash now in all transaction

I will post a review once I get my own Gcredit approval, so stay tuned.