Payoneer, a leading online payments company transforming the way businesses send and receive cross-border payments, announced today the expansion of its operations in the Asia Pacific region as it formally opens its office in the Philippines.

The New York-based global financial services firm that provides payment solutions to giant entities such as Google, Amazon, Upwork and Airbnb, as well as millions of small businesses throughout the world, is strengthening its presence in a country that is already very familiar with its services. Its local presence in Manila will enable Payoneer to offer even better service to freelancers and creative outsourcing professionals, as well as the growing numbers of SMEs in the IT and BPO industry in the Philippines.

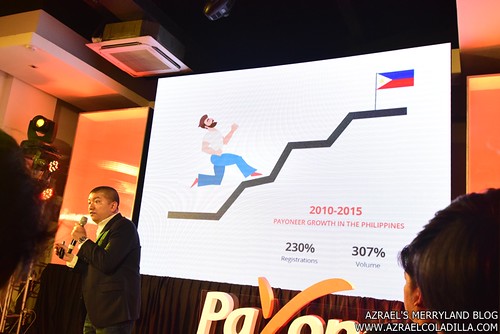

Payoneer has long recognized the rapidly growing outsourcing and export market in the Philippines. According to the World Bank Global Opportunity in Online Outsourcing[1] report released last year, the global online outsourcing industry is set to generate revenues in the range of $15 to $20 billion by 2020. The Philippines, comprising 18.6% of the global online workforce, is listed in the same report as among the top five countries for online outsourcing. Through its cross-border payment platform built for today’s digital age, Payoneer is continuing to empower this market growth.

“Receiving international business payments in a timely and cost-effective manner is oftentimes a big hurdle for small businesses and freelance professionals,” noted Miguel Warren, who was recently named as Payoneer’s Country Manager in the Philippines. “With all the global opportunities in online business, the last thing Filipino freelance professionals, online entrepreneurs and SME BPOs need to worry about is getting paid by their international clients. Payoneer can provide them with fast, flexible and low-cost solutions that will help them scale their global businesses,” he shared.

“At Payoneer, it is our mission to empower entrepreneurs and small business owners in the Philippines to connect with opportunities that will help them grow their global business and achieve their potential,” said Scott Galit, Payoneer CEO. “The freelance and outsourcing market in the Philippines sets a great example to the rest of the world and it is an honor to help their continued expansion by providing a secure, low-cost platform for cross-border payments.”

Payoneer has millions of users from over 200 countries and territories worldwide, providing cross-border payments through marketplaces and directly between buyers and sellers in more than 150 currencies.

To learn more about how Payoneer is empowering Filipino businesses and professionals with its fast, low-cost and flexible cross-border payments platform, visit www.payoneer.com/ph.